Back in 2019, we wrote about when to offer an exclusive on funding news, but since then a lot has changed. According to Crunchbase data, global venture funding hit an all-time high of $125B in Q1 2021, with late-stage funding deals taking the lion’s share of that pie. Due to the rapid increase in digital transformation efforts brought on by the global pandemic, technology adoption is on the rise, as are venture capital investments in technology startups from early stage onward.

So, it stands to reason that we’re doing more funding announcements than ever before, which got me thinking about which strategy — exclusive or broad embargo pitching — could consistently yield the “best” results for SaaS companies. For the purposes of this article, I’ll use “exclusive” in reference to offering a single reporter the opportunity to cover your news, and “embargo pitching” in reference to pitching several reporters the news under embargo before the announcement date.

A note on offering an exclusive

Why offer an exclusive? Well, in quick summary, doing so can make the news more “attractive” to a reporter whose cup already runneth other with things to cover, and usually means they’ll write something a little more in-depth than a regurgitation of the press release. On the flip side, it lessens the chance other top tier outlets will care (since they won’t get a heads-up on the news before it is live) and could lower overall coverage totals.

Before diving into the data, I feel the need to offer a disclaimer. There’s no “one size fits all” approach to a funding announcement (or any announcement for that matter). Weigh the pros and cons, consider the below questions, and consult with your SaaS PR agency before going all in, and deciding to offer an exclusive (or vice versa).

Things to think about when determining a PR strategy for your SaaS funding announcement:

- Goals — Who are you trying to reach, and what are they reading? Have you always wanted to be in a certain publication? Do you only care about volume of coverage? Do you care if coverage is behind a paywall? Do you want to “beat” a competitor’s previous funding announcement? Think about these questions, and determine what it is you want out of your 15 minutes of fame. Make sure those goals are clear to your PR team so they can pick an announcement strategy that aligns with your vision.

- Industry — Results and coverage quantity will vary depending on industry. There are a lot more marketing trade publications more accustomed and receptive to covering funding news than there are higher education pubs willing to do the same. Tier-1 outlets like Forbes and Bloomberg may or may not have a beat reporter assigned to your industry, which changes how likely a certain outlet is to bite on, or even have time to cover your news.

- Lead time — If you want reporters to cover your news, give them lead time. If you don’t have a lot of it, you may not have time to make a few (or any) exclusive offers.

- Third parties — Are your investors heavily involved in the announcement? Are they aware of your goals for the announcement and do they agree? I’ve been in more than a few situations where our team determined an announcement strategy with a client, only to have it upended by a VC or their comms agency. The sooner all parties are involved in the discussion, the better.

- Supporting storylines — Think now about what “extras” you can offer to extend the life of your funding news. Do you have a customer story you can pitch? A “behind the scenes” deck you can show? Get those items in order prior to announcement day so you can strike while the iron is hot, offering the stories alongside the funding hook.

Back to the data, and a bit of background

I am currently chasing a (perhaps somewhat delusional) funding announcement dream scenario — I’d like to get Insider, Bloomberg, Forbes, VentureBeat and TechCrunch to all cover my client’s funding news. I realize achieving that would only be possible with the right news, and an unlikely week where reporters at those publications had time available to write the story. But, let’s evaluate for the best case scenario.

Recently, our agency executed two funding announcements for companies with unicorn valuations within one week of each other. Client A raised a $125 million Series D at a $2.1 billion valuation near the end of March. Client B announced its $100 million Series D and corresponding $1.4 billion valuation just eight days later. For Client B, we went the exclusive route, and for the other, we chose broad embargo pitching (see above section on “things to consider” if you’re wondering why we opted for different strategies). Differences aside, that’s a pretty fair playing field for comparison.

A breakdown on the results

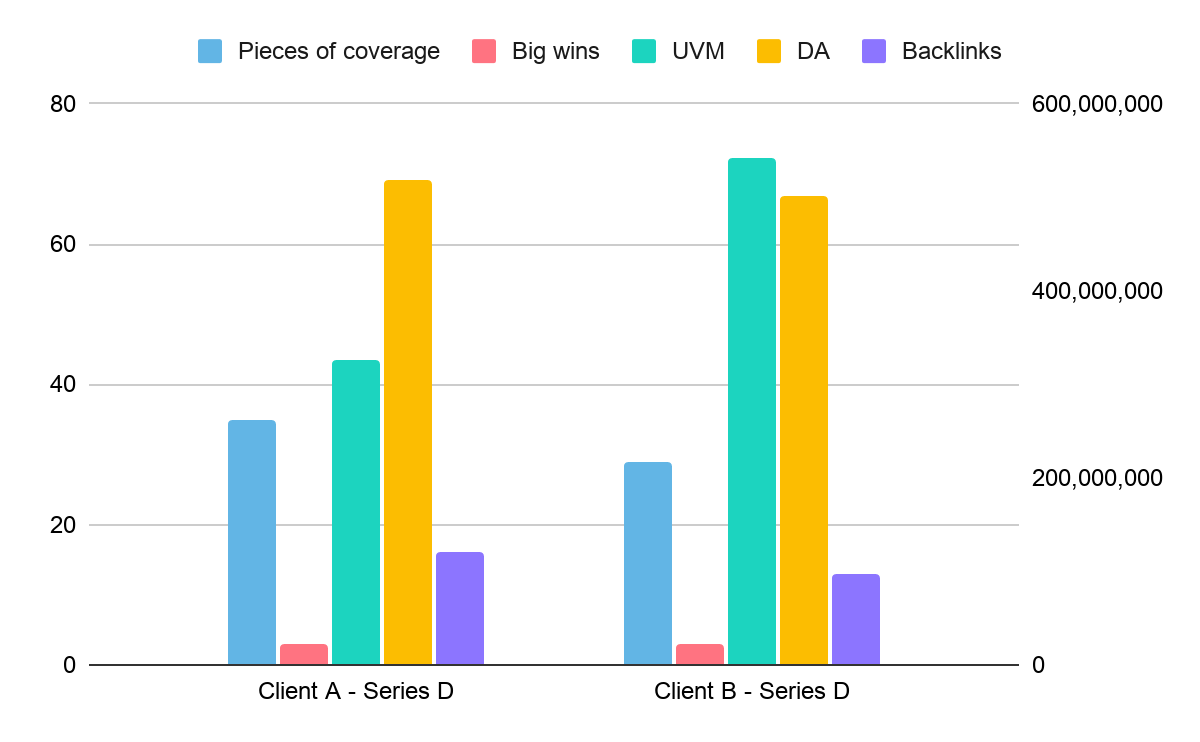

Client A funding announcement — no exclusive

- 35 pieces of coverage

- Big wins: TechCrunch, VentureBeat, Reuters

- Average Domain Authority of coverage: 69

- UVM total: 326,290,462

- Percent of coverage with a backlink: 46% (16)

Client B funding announcement — exclusive (Bloomberg)

- 29 pieces of coverage

- Big wins: Bloomberg, Forbes, Insider

- Average Domain Authority of coverage: 67

- UVM total: 542,994,070

- Percent of coverage with a backlink: 45% (13)

Overall, the results were pretty even. We secured more coverage for Client A, which makes sense given the strategy of embargo pitching, meaning we shared the news with more outlets before the announcement date and the industry trade pickups in marketing publications. Otherwise, we got the same number of “big wins,” the same percentage of backlinks, and coverage had the same domain authority. The biggest difference is the total potential reach of coverage (UVM: unique monthly visitors) — 500 million for Client B vs. 300 million for Client A. Taking these numbers with a grain of salt (we know they’re not always the best measure of PR success), the data essentially shows us the three “big wins” we secured for Client B were simply bigger in reach than the “big wins” we secured for Client A.

So, can you catch ‘em all?

Here’s what we’ve learned about the top publications we would love to see cover our SaaS clients’ funding news (*clears throat* these are big generalizations and remember, each individual reporter will have their personal preference):

- Insider — Likely requires an exclusive on straight news, but there is opportunity for coverage outside of just the funding (look into the pitch deck series). At a minimum, have an exclusive list of customers to give them.

- Bloomberg — Needs an exclusive.

- Forbes — If you’re pitching Alex Konrad or Becca Szkutak, you’ll likely need an exclusive. But look for other staff writers outside of those two who cover your industry — they might not need one if the story is good enough.

- VentureBeat — Doesn’t need an exclusive, absolutely does need a heads up before the news goes live.

- TechCrunch — Doesn’t always need an exclusive, though some reporters prefer them. Your best bet for coverage here comes down to lead time and availability.

So, unfortunately, the answer is no, I don’t think there’s a world where they all cover the same funding news (unless you’re Coinbase). Since Bloomberg requires an exclusive (at least in our experience) it’s unlikely you’ll be able to give the other publications the lead time they need to also cover the news. Keep in mind these were both Series D announcements with valuations more than $1 billion. If you’re working with news where the round is smaller/earlier, and especially if the valuation isn’t disclosed, you will need to recalibrate your expectations.

Earlier this year Alex Wilhelm (TechCrunch) offered some great insight on pitching early-stage rounds, diving into the imbalance in the number of those rounds (and PR people pitching them) compared to the number of reporters covering them. He explains why it’s so tough to get coverage for seed or Series A raises, and why sometimes the most likely response is “this sounds cool — I don’t have time to cover it.”

As always, if you want the best chance at securing a meaningful story for your funding news, give us a call (at least two months before your news goes live).